EURUSD Alert: RSI Divergence and Upcoming Rate Decisions

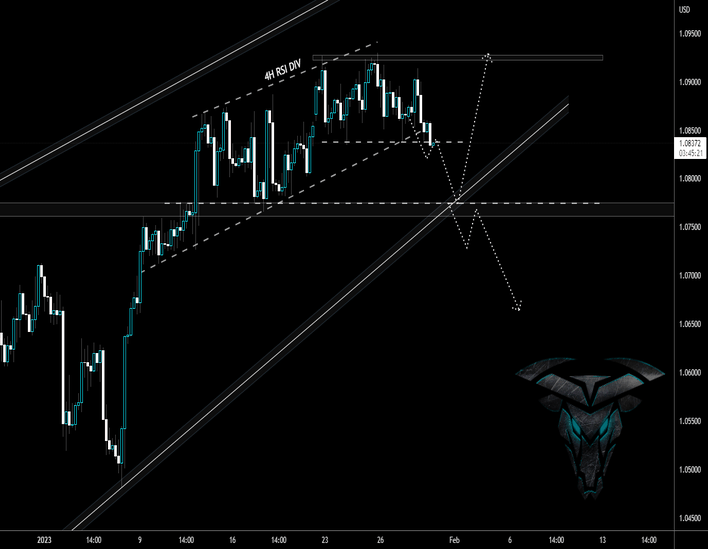

The EURUSD has been on an upward trajectory for quite some time now, but the recent price action on the 4-hour chart has raised some concerns. A RSI divergence has been observed, which is usually a bearish signal. As a result, caution is advised for traders who are currently holding long positions in the pair.

The upcoming rate decisions from both the Federal Reserve and the European Central Bank are likely to have a significant impact on the EURUSD . The FED is expected to raise interest rates by 25 basis points, while the ECB is expected to raise rates by 50 basis points. These rate hikes will have a direct impact on the strength of the US dollar and the euro , respectively.

It’s important to keep a close eye on the trendline and support levels that have been drawn up on the chart. If the price of the EURUSD bounces off the support level , it could indicate a continuation of the uptrend. However, if the price breaks below the support level , it could lead to further downside.

In conclusion, the EURUSD is facing some uncertainty in the short term due to the upcoming rate decisions and the bearish signal on the 4-hour chart. Traders should stay vigilant and closely monitor the trendline and support levels to make informed trading decisions. With the FED expected to raise rates by 25 basis points and the ECB expected to raise rates by 50 basis points, the next few days could be critical for the EURUSD . Good luck traders!

Check out my previous post “Breaking Down The FX Market: What You Need To Know” for a comprehensive video analysis.