Break Down: Analysis of The DXY, EURUSD, GBPUSD, US100 & More

In this video, we’ll take a closer look at the charts we covered in our last live session, updating and explaining our analysis. Our focus will be on the following currency pairs: DXY , EURUSD , GBPUSD , NZDUSD , AUDUSD , EURCAD , and US100.

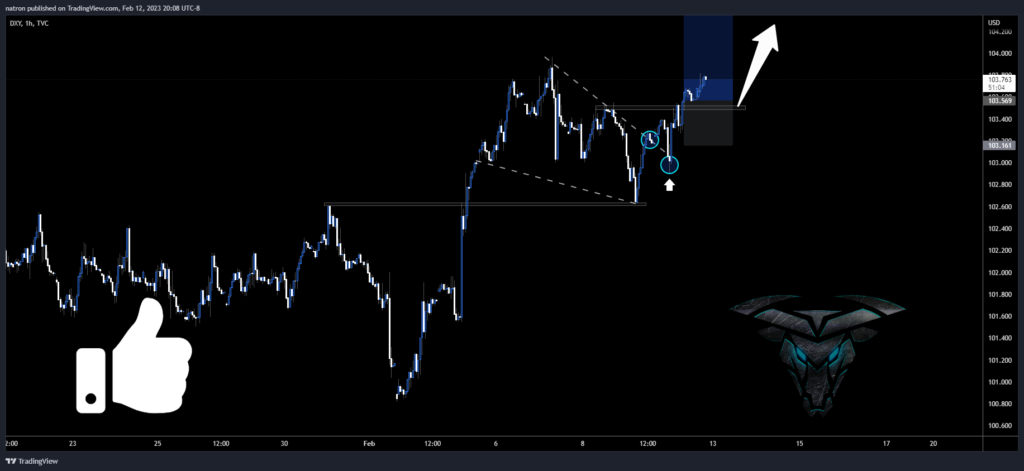

We’re currently seeing a lot of potential for dollar strength, but it’s important to keep an eye on the upcoming CPI release on Tuesday, as it could create some volatility in the markets. As a simple rule of thumb, when inflation is up, the dollar tends to strengthen, and when inflation is down, the dollar tends to weaken. However, it’s not always that simple, and it’s important to pay attention to the details.

When evaluating the CPI data, consider the following: how much it beat or missed the estimate, whether there is mixed data, if the data was as expected, and any revisions to the previous numbers. Additionally, pay attention to the rhetoric of central bank members after the release, as this can also impact market sentiment.

Our analysis of the downside trades is closely tied to the inflation data release. A strong beat in inflation would likely result in successful trades. However, a significant miss in the data could invalidate many of these trades.

If you’re currently not in any trades, it may be wise to wait until after the CPI release. While it’s tempting to try and get ahead of the market by positioning yourself, the risk of getting caught in a ranging market before the event could result in significant losses. It may be better to wait for a clearer direction after the release.

Join us as we navigate through these charts and look for possible trades in the market. Let’s stay vigilant and make informed decisions.